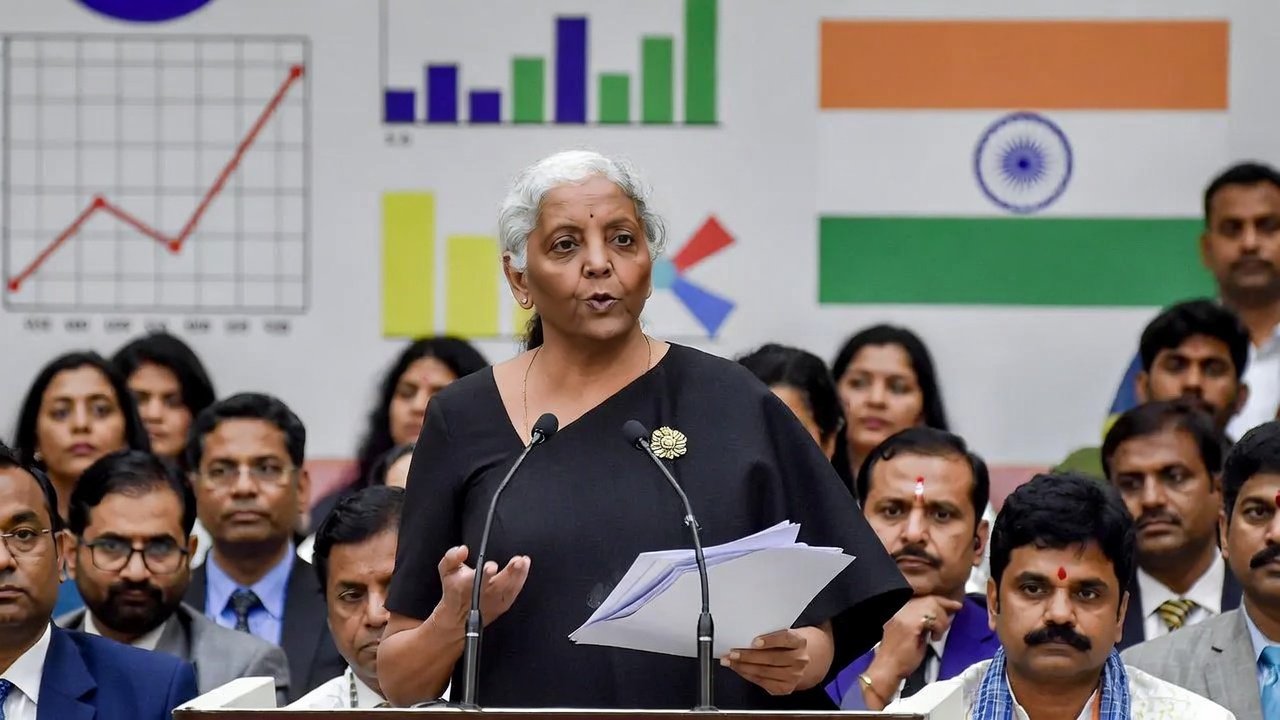

With the Economic Survey 2025-26 setting the tone, markets, investors, and industries are closely tracking policy signals related to economic growth, taxation, capital markets, and sectoral reforms.

“An oasis of macro stability in a turbulent world.”

Key growth drivers highlighted include:

Strong domestic consumption

Controlled inflation levels

Robust foreign exchange reserves

Improved fiscal discipline

However, the Survey also cautions against external headwinds, including slowing global demand and uncertainty in international trade.

One of the key expectations from Budget 2026 is GST rationalisation, especially to support Electric Vehicle (EV) adoption. Experts believe rationalised GST rates on EVs, batteries, and charging infrastructure could:

Reduce costs for consumers

Boost domestic EV manufacturing

Accelerate India’s clean energy transition

Policy clarity in this area may significantly benefit EV-related stocks and the broader auto sector.

Markets will remain open on Budget Day, with both NSE and BSE operating normal trading hours. Investors are entering Budget Day with muted expectations, focusing mainly on:

Possible relief in Long-Term Capital Gains (LTCG) tax

No increase in Securities Transaction Tax (STT)

Continued push towards ease of doing business

Stable fiscal roadmap without aggressive taxation

Any positive surprise on capital gains taxation could act as a sentiment booster for equity markets.

Key areas investors and industry leaders will track include:

Infrastructure & capital expenditure (capex)

Export competitiveness and trade diversification

Manufacturing & MSME support

Income tax slabs and compliance simplification

EVs, renewable energy, and green mobility

Balanced sectoral allocations will be crucial to sustaining growth momentum while maintaining fiscal discipline.

Prime Minister Narendra Modi has reiterated that Budget 2026 should focus on:

“Reform, Perform and Transform”

The emphasis is expected to shift from solving long-pending issues to delivering long-term structural solutions, strengthening India’s economic resilience.

With India positioned as one of the fastest-growing major economies, Budget 2026 will play a pivotal role in shaping:

Investment flows

Sector-specific opportunities